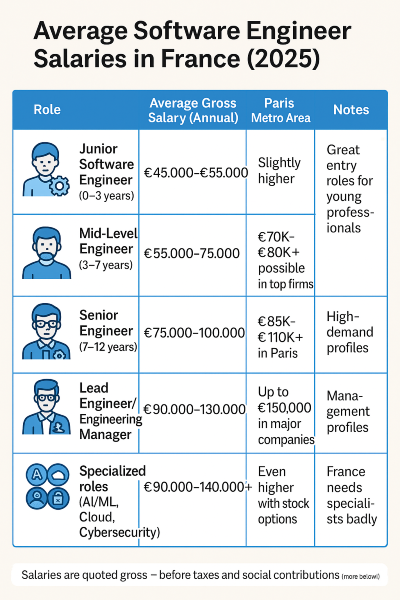

How Much Can You Earn as a Software Engineer in France? (And Is It Enough to Live Well?)

If you’re considering moving to France for a tech career, you’re probably wondering:

How much do software engineers earn in France — and is it enough to live well?

This guide gives you the full breakdown of salaries, benefits, and cost-of-living considerations for software engineers in Paris and across France.

Spoiler: for American professionals used to Silicon Valley rates, it’s different — but many find the tradeoffs well worth it.

Average Software Engineer Salaries in France (2025)

➡️ Related guide: [Top Tech Jobs in France for American Professionals in 2025] (internal link)

Why Salaries in France Are Different From the U.S.

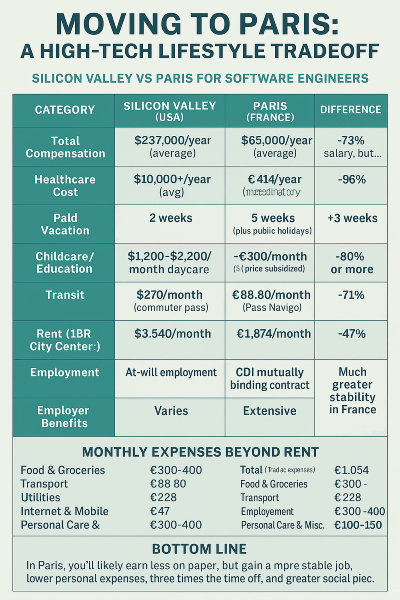

Many American engineers are used to Silicon Valley salary structures — huge base salaries, big bonuses, stock options.

In France, compensation works a little differently:

- Higher job security: French contracts often come with strong worker protections.

- Mandatory benefits: Employer-paid healthcare, retirement contributions, and unemployment insurance.

- More vacation: Standard is 5 weeks paid vacation per year — plus public holidays.

- Lower personal costs: Healthcare, education, and some living expenses are far cheaper.

Bottom Line: Your gross salary may be lower, but your overall quality of life and cost structure often improve dramatically.

Why Paris Makes Strategic Sense for Silicon Valley Engineers

For experienced tech professionals used to Silicon Valley standards, Paris offers the closest match in opportunity — home to the highest concentration of multinational R&D labs, AI hubs, and major U.S. tech offices. Paris provides a globally competitive environment combined with the unique advantages of France’s social protections, cost savings, and work-life balance.

Tip: Most high-level Silicon Valley candidates will find the best match and salary in Paris.

What About Taxes?

Yes, France has higher income tax and social contributions — but it’s manageable and often offset by benefits.

As a rough guide:

- Expect around 25–30% of your gross salary to go toward taxes and social contributions.

- The system is progressive: higher earners pay a higher percentage.

Good to Know:

Your French employer automatically withholds most contributions, simplifying your tax filing.

➡️ Related guide: [Tax Considerations for Americans Working in France] (internal link)

Extra Compensation and Perks

French tech companies offer a variety of extras:

- Mutuelle (supplemental health insurance) – usually 100% employer-covered

- Restaurant tickets – subsidies for meals

- Annual bonus – not always guaranteed but common

- Profit-sharing plans – popular among startups

- Relocation packages – for international hires

- Visa sponsorship – often included for Americans

Pro Tip: Always ask about relocation assistance — many companies offer it but don't advertise it loudly.