Why Moving to Paris Could Be a Smart Career and Retirement Decision — Backed by Real Numbers

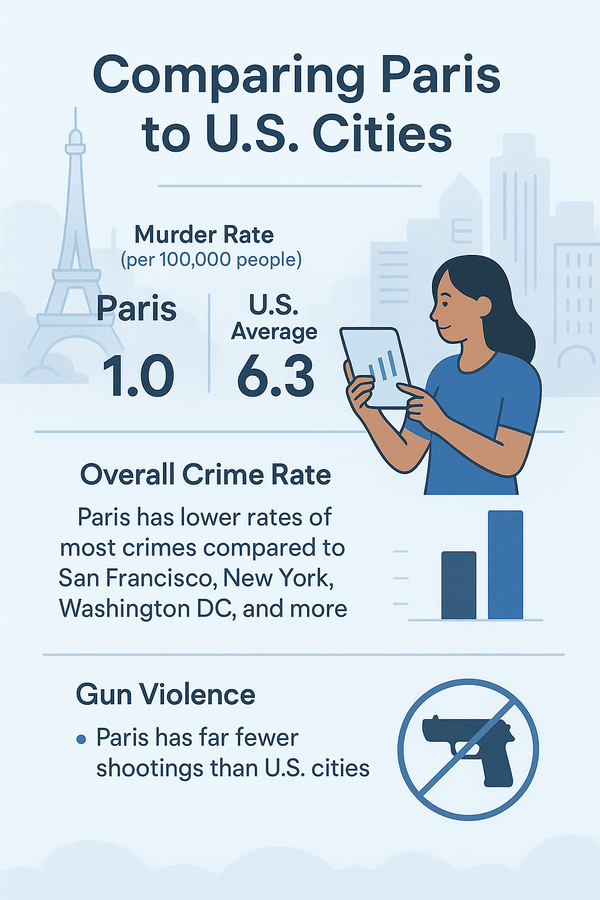

For high-earning U.S. professionals in tech or management — especially those based in San Francisco — the idea of relocating to Paris might seem bold. But beneath the surface, this move could be one of the smartest decisions for your career and retirement strategy.

Here’s what the data really says.

1. Cost of Living: Paris Is Up to 28% Cheaper Than San Francisco

If you’re earning a U.S. tech salary, your dollar stretches further in Paris. According to verified data:

- Expatistan shows that the overall cost of living in Paris is 22% lower than in San Francisco.

- Numbeo indicates that San Francisco is 42.6% more expensive than Paris when factoring in rent.

Key cost advantages:

- Housing: Rent is up to 32% cheaper in Paris.

- Groceries: Staples like fruits, vegetables, and bread cost far less.

- Healthcare: A visit to a private doctor in Paris averages $35–$50 versus $200+ in San Francisco.

- Utilities: Lower monthly bills in most categories (internet, electricity, gas).

Bottom line: If you keep earning in USD or maintain a competitive French tech salary, you can increase your savings rate while living in one of Europe’s most dynamic cities.

2. Paris Is a Serious Tech Hub — Not a Slower Career Track

Forget the clichés. Paris is no longer just for artists and philosophers. It’s a modern innovation hub with:

- 25+ French unicorns (startups valued over $1B), including Back Market, Qonto, and Doctolib.

- Major investments in AI, quantum computing, cybersecurity, and green tech.

- A fast-growing international ecosystem: Station F is the largest startup campus in the world.

Hiring trends show growing demand for:

- AI/ML engineers

- Product managers

- Cloud architects

- DevOps and data professionals

And most of these jobs now offer English-speaking environments.

3. You Keep Your U.S. Retirement Accounts — and Gain a Public Pension

Worried about losing access to your 401(k), Roth IRA, or brokerage accounts? Here’s the truth:

- You can keep them open and growing — even after relocating abroad.

- While you generally can’t contribute to U.S. IRAs unless you have U.S.-sourced earned income, you can still manage and reinvest within those accounts.

- You can opt into the French public pension system through employment or contributions, building credits for your retirement in Europe.

Thanks to the U.S.–France Totalization Agreement:

- You won’t pay into both U.S. Social Security and French pensions at the same time.

- Your years worked in France can count toward U.S. Social Security eligibility.

4. Taxes: Yes, It’s Complex — But Double Taxation Is Avoided

Let’s be clear: taxes matter. But moving to France does not mean paying taxes twice.

- The U.S.–France tax treaty avoids double taxation.

- The Foreign Earned Income Exclusion (FEIE) lets U.S. citizens exclude up to $126,500 (2024) of foreign-earned income from U.S. tax.

- France and the U.S. allow foreign tax credits to offset what you pay in either country.

Yes, you’ll need a qualified accountant familiar with international taxation — but the system is manageable and designed to prevent duplication.

5. Retirement Strategy: Diversification and Security

Smart retirement planning means diversifying:

- Keep your 401(k) or IRA for U.S.-based retirement investments.

- Earn credits in France’s public pension for a base layer of lifetime income.

- Invest locally in France (real estate, equity accounts) under your French tax residence.

- Protect your savings from currency risk and political volatility by splitting assets across systems.

With the right planning, you can retire in France, the U.S., or even somewhere else entirely — with income from both public and private systems.

Final Thought

Paris offers a globally connected career path and a sophisticated social safety net — without the burnout culture or extreme living costs of San Francisco. For high-earning professionals thinking long-term, the numbers point to Paris as a serious strategic move.

Want more information on how to make the leap — legally, financially, and professionally?

📩 Contact: franceexpatservices@gmail.com

We’ll help you navigate every step.